Investing

Flexi-Growth Term Deposit

Great rates and the flexibility to cash-in at any time.

Investing

Flexi-Growth Term Deposit

Great rates and the flexibility to cash-in at any time.

Key Differentiating Features

Features and Benefits

Ways to Invest

Our advisors can help you purchase or renew your investments over the phone or in branch so you can achieve your financial goals.

Our advisors provide access to comprehensive, customized financial management built through integrity, ethics and responsibility.

Bank anywhere with our online banking options. Buy or renew GICs/Term Deposits online or set up transfers.

Tap into timely insights and tools to invest with confidence in all market conditions with Qtrade® Investor.

Articles

A Guaranteed Investment Certificate (GIC) is a safe and secure investment choice with a very low risk. Here are five reasons why you should consider investing in a GIC.

Good habits can help you be a better investor, and these five good habits can help you successfully invest for retirement.

Whether you have short-term or long-term savings goals, there is a term deposit that will provide you with the security and flexibility you need.

You may also need...

Investment Savings Account

A high-interest savings account that helps you reach your savings goals faster.

Investment Shares

Looking for a unique investment opportunity? From time to time, Alterna members are given the exclusive right to invest in their credit union through our Investment Shares. These shares are also eligible for RRSP and TFSA accounts.

TFSA

A tax-free savings account (TFSA) is so much more than a regular savings account. Your savings grow tax-free, and you can use it to hold a variety of investments. Open one today to help you reach all of your savings and investing goals.

Wealth Solutions

Alterna Wealth can help manage your investments so you can build, strengthen and preserve your wealth.

RRSP

An RRSP allows you to make tax-deductible contributions and your savings to grow tax free until withdrawn from the plan.

How can we help?

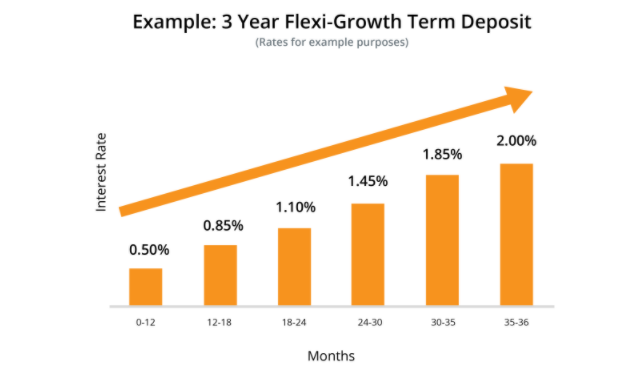

2- and 3-year Flexi-Growth Term Deposits: Annual compound interest paid annually, at redemption or at maturity. Interest earned must be reinvested back into the term deposit. Redemption available any time after 90 days. No partial redemptions permitted. If term is redeemed any time after 90 days prior to the 1-year anniversary, simple interest will be calculated on the principal amount for the number of days in the term and paid at redemption (principal x rate x number of days / 365 days). Minimum investment $500. Available to personal accounts only. Due to local and proxy caching on the Internet, please ensure that you are viewing current rates.

Your financial well-being comes first

Welcome to a better way to bank. Our knowledgeable team puts your financial well-being first with good, caring and transparent advice while offering all the products and services you need.