Investing

Global Diversified Guaranteed Return

Investing

Global Diversified Guaranteed Return

Alterna’s MarketTracer Term Deposit – Global Diversified Guaranteed Return is similar to a regular term deposit, but the return is based on the market performance of twenty large corporations representing economic sectors in the developed countries. That means you can participate in the performance of twenty global companies while guaranteeing 100% of your principal investment. On top of it all you’ll receive a guaranteed minimum return paid annually!

For more information or to invest in the Alterna MarketTracer Term Deposit – Global Diversified Guaranteed Return, contact us.

Product Information

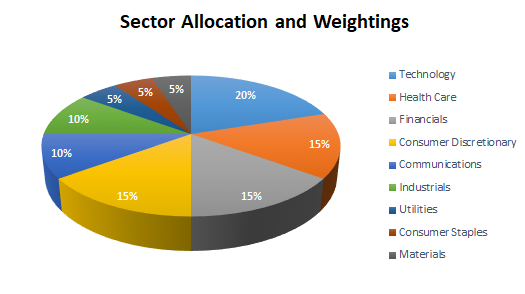

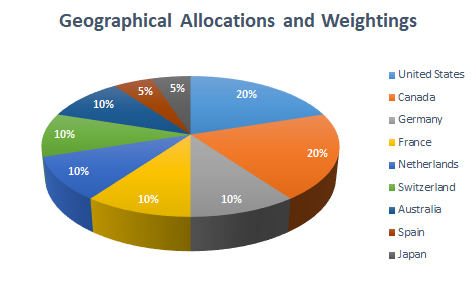

The composition and weightings of the Global Diversified Guaranteed Return is provided below.

Alterna’s MarketTracer Term Deposit – Global Diversified Guaranteed Return At a Glance | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Sales Period: | Currently unavailable | |||||||||

Index | Equal weighting of 20 large corporations representing economic sectors in the developed countries | |||||||||

Term (non-redeemable) | 3 Year | |||||||||

Minimum Investment | $500 | |||||||||

Principal Guaranteed | Yes | |||||||||

Guaranteed Annual Return | 0.33% | |||||||||

Guaranteed Cumulative Appreciation | 1.00% | |||||||||

Maximum Cumulative Appreciation | 5.50% | |||||||||

Market Participation | 100% | |||||||||

Plan Eligibility | RRSP and TFSA | |||||||||

FSRA Eligible | Yes | |||||||||

* 1.00% refers to the minimum cumulative return of the 3 year term (0.33% guaranteed annual return). 5.50% refers to the maximum cumulative return possible on the 3 year term. Minimum investment $500. Rate subject to change without notice. See in branch for details.

Alterna’s MarketTracer Term Deposit – Global Diversified Guaranteed Return is right for you if you:

Benefits

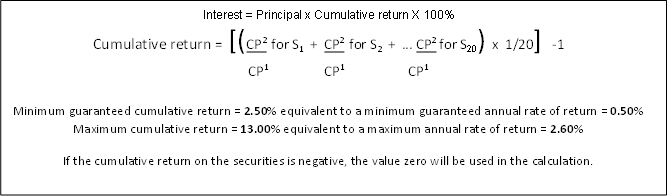

Return Calculation and Example

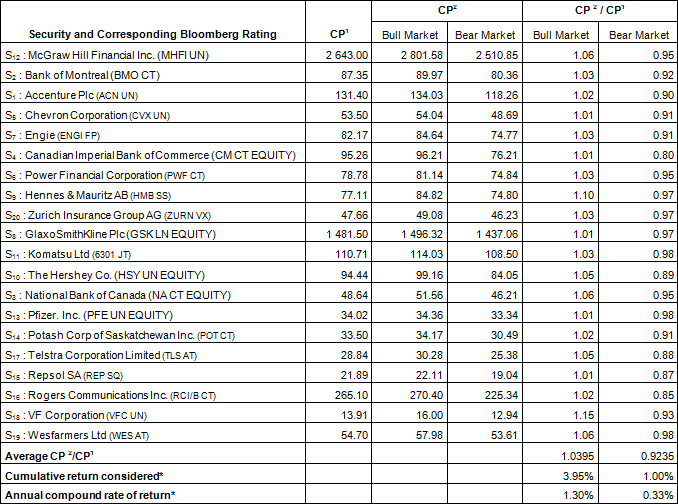

Example of Return Calculation at Maturity (5-year term)

* The return is presented for information purposes only and is not indicative of future performance. The maximum cumulative return of this example investment is 13.00%. If the return at maturity is higher than 13.00%, the return paid will be 13.00%.

Definitions:

Principal: The amount of the Initial Deposit

CP²: The average closing price of each security on April xx, 2020, May xx, 2020 and June xx, 2020 (or the following business day if no reading takes place on this security on any of these dates).

CP¹: The price of each security at closing on June xx, 2015 (or the following business day if no reading takes place on this security on this date).

S1 to S20: Each one of the twenty (20) securities listed below.

100%: The rate of participation in the growth of the basket of securities.

Alterna refers Alterna Savings and Credit Union Limited (operating as Alterna Savings).

Your financial well-being comes first

Welcome to a better way to bank. Our knowledgeable team puts your financial well-being first with good, caring and transparent advice while offering all the products and services you need.