Investing

Canadian Index

Investing

Canadian Index

Alterna’s MarketTracer Term Deposit - Canadian Index is similar to a regular term deposit, but the return is based on the performance of the S&P/TSX60 index. That means you can participate in the Canadian stock market while guaranteeing 100% of your principal investment.

For more information on the Alterna MarketTracer Term Deposit - Canadian Index, contact us.

Product Information

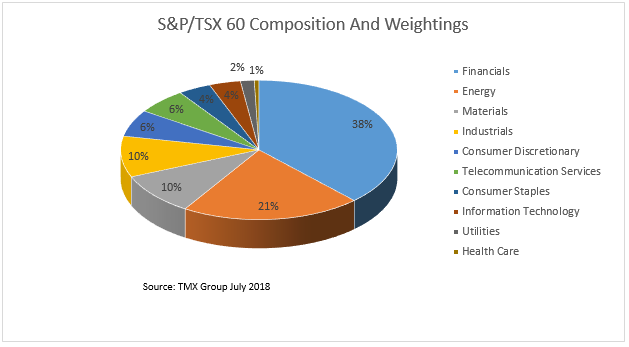

The S&P/TSX60 index is the most widely traded equity index in Canada.

Alterna’s MarketTracer Term Deposit - Canadian Index at a glance | ||||||||

|---|---|---|---|---|---|---|---|---|

Sales Period: | Currently unavailable | |||||||

Index | S&P/TSX60 | |||||||

Term | 3 or 5 years (non-redeemable) | |||||||

Minimum Investment | $500 | |||||||

Principal Guaranteed | Yes | |||||||

Cap on Returns | None. Alterna doesn’t cap your return, so if the market does well, so do you | |||||||

Market Participation | 75% for the 3 year term, or 125% for the 5 year term | |||||||

Plan Eligibility | RRSP and FSRA | |||||||

FSRA Eligible | Yes | |||||||

• Insurable deposits covered by the Financial Services Regulatory Authority of Ontario (FSRA), formerly DICO

• At Alterna Savings Credit Union, insurable non-registered deposits are covered up to $250,000. Insurable deposits in registered accounts have unlimited deposit coverage

• For further information on deposit insurance, please ask for a brochure at the credit union or visit FSRA’s website at www.fsrao.ca

Alterna’s MarketTracer Term Deposit - Canadian Index is right for you if you:

• Are looking for the potential to earn higher returns associated with the S&P/TSX60

• Want to diversify your investment portfolio

• Want peace of mind knowing your principal is protected

• Will not need access to your funds during the term of the investment

Fact Sheet & Performance

Product Fact Sheet (PDF)

Take a look at our current Canadian Index Performance (PDF)

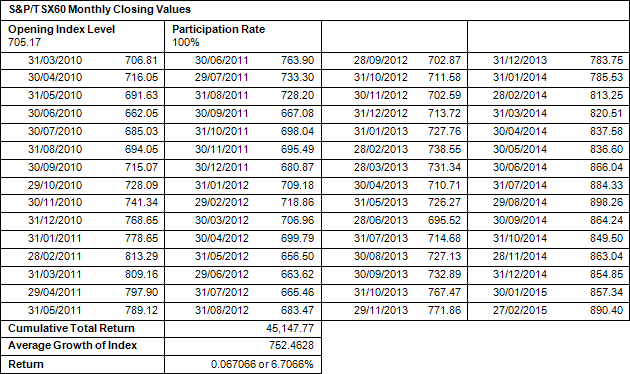

Alterna’s MarketTracer® Term Deposit - Canadian Index Past Performance

The S&P/TSX60 Index is made up of 60 of the largest publicly traded, blue chip companies in Canada. Their stock values are tracked daily and reflected in the index, which acts as an indicator of market performance.

Benefits

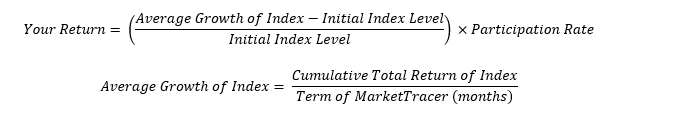

Return Calculation and Example

Example of Return Calculation (5 Year Term) *

Initial Investment of $10,000 with Initial Index Level of 585.

The average growth of the S&P/TSX60 Index over the term of the deposit is 662.50. The Participation Rate is 110%.

At maturity, the investor will receive:

[(Average Growth of Index – Initial Index Level) ÷ Initial Index Level]

[(662.50 – 585) ÷ 585] = 0.1325

0.1325 X Participation Rate X Initial Investment

0.1325 X 1.10 X $10,000 = $1,458 + Initial Investment

Total Amount Received

= $1,458 + $10,000

= $11,458 for a total of 14.58%

Should the Average Growth of the Index be lower than the Initial Index Level, the Return on the MarketTracer Term Deposit will be 0.00% and the investor will receive only their principal investment at the end of the term.

* The above is for informational purposes only and is not indicative of actual performance.

Example of Return Calculation (5-Year Term)*

* This example calculation is for informational purposes only and has no relation to future performance.

Definitions:

Cumulative Total Return of Index: Addition of the closing levels of the index on each Valuation date of the investment.

Initial Index Level: The closing level of the index on the start date of the MarketTracer.

Participation Rate: The percentage of the return of the MarketTracer that you will receive.

Interest Paid: The interest paid will be based on a percentage (gross up) of the average monthly growth of the S&P/TSX60 over the term of the deposit.

Index: S&P/TSX60 Index.

Arithmetic Average: Means the sum of the stock price index value of an Index on each of the Valuation Dates between the Index Set Date and the Maturity Date, divided by the number of Valuation Dates.

Index Set Date: The date on which the starting value of the Index is established.

Participation Rate: Leverage ratio by which the percentage growth of the Index (as per the averaging formula) is multiplied.

Index Business Day: Means any day on which commercial banks are open for business in Toronto and is (or, but for the occurrence of a Market Disruption Event, would have been) a trading day on the Toronto Stock Exchange and the Related Exchange, other than a day on which trading on the Toronto Stock Exchange or the Related Exchange is scheduled to close prior to its regular weekday closing time.

Valuation Time: At the close of trading on the related stock exchange.

Valuation Date: Means the 8th day of each month (or the following Index Business Day) for each month during the Term, unless there is a Market Disruption Event on any one of those Valuation Dates.

S&P® and TSX™ are registered trademarks of Standard & Poor’s Financial Services LLC and the Toronto Stock Exchange and have been licensed for use by Alterna Savings.

The product is not sponsored, endorsed, sold or promoted by Standard & Poor’s or the Toronto Stock exchange and neither Standard & Poor’s nor the Exchange Partner makes any representation regarding the advisability of investing in the Product.

Alterna refers to both Alterna Savings and Credit Union Limited (operating as Alterna Savings) and CS Alterna Bank (operating as Alterna Bank).

Alterna Bank is a wholly-owned subsidiary of Alterna Savings.

Your financial well-being comes first

Welcome to a better way to bank. Our knowledgeable team puts your financial well-being first with good, caring and transparent advice while offering all the products and services you need.