Homebuying

Multi-Option

Homebuying

Multi-Option

A mortgage that lets you access the equity in your home.

The Alterna Multi-Option Mortgage lets you combine your home financing and credit options, all within one account.

Alterna’s Multi-Option Mortgage allows you to use the equity in your home to manage all your credit needs. It’s like a line of credit and mortgage combined into one to help you meet your changing financial needs.

How does the Alterna Multi-Option Mortgage work?

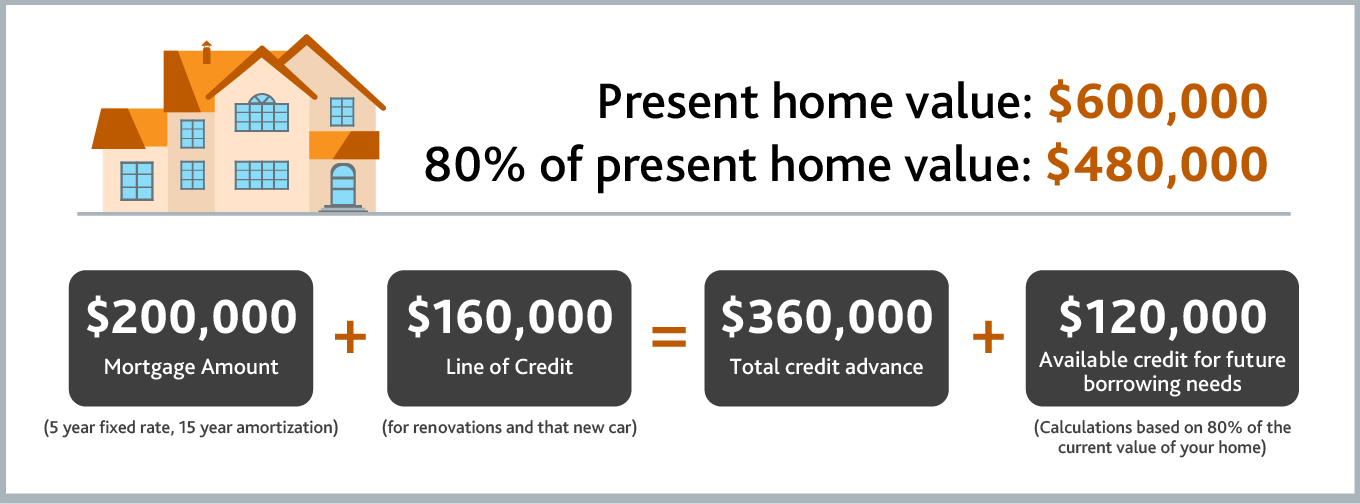

If you currently have more than 20% equity in your home, you can access additional credit worth up to 80% of your home's current market value. In other words, your mortgage and other loans can total up to 80% of the appraised value of your home.

Over time, as you pay down your mortgage, you can easily draw on this growing equity you have in your home.

You can use your Multi-Option Mortgage to get the credit you need. Whether you want to do some renovations, take a vacation or want the comfort of knowing you have access to “just-in-case” funds, you’re covered.

Benefits of the Multi-Option Mortgage

Combines a conventional mortgage with a line of credit to support all your borrowing needs

Provides you with the reassurance of knowing you have pre-approved credit

Saves you from having to pay additional expenses to apply for a new loan in the future

For example: Janet and Bob have paid down half of their mortgage (originally, seven years ago, it was $400,000. Now it’s $200,000). They’d like to do some renovations and buy a car. A Multi-Option Mortgage can provide them with the money they need, at a lower interest rate than other finance options.

That would mean Janet and Bob’s Muiti-Option Mortgage portfolio could look like this:

Contact an Alterna mortgage specialist to find out how you can make the most of the equity in your home.

Our current mortgage rates

5-yr variable closed - high ratio

interest rate

3-yr fixed closed - high ratio

interest rate

5-yr variable closed - conventional

interest rate

*rates subject to change

Tools and resources

Get Started

Whether you’re getting your first mortgage, renewing, switching or refinancing, we’re here to help you every step of the way. Start with a conversation—find out how easy it can be. Contact one of our Mortgage Specialists today.

Articles

Consider these 8 things to help you pick a mortgage that's right for you.

Find out if you'll be able to afford your mortgage if interest rates rise.

Use this checklist to review all your options when your mortgage is up for renewal.

You may also need...

Mortgage Default Insurance

Is your down payment less than 20%? You need mortgage default insurance.

Secured Line of Credit

Get access to funds at a lower interest rate, backed by security like the equity in your home.

Chequing Account

Find a smarter way to make your money work for you. Alterna has a banking package to suit your every need.

Credit Cards

We have a credit card to fit your lifestyle. Whether you’re looking for valuable reward points, unique partner benefits or simply lower fees, you can choose the card that's right for you.

Wealth Solutions

Alterna Wealth can help manage your investments so you can build, strengthen and preserve your wealth.

Creditor Insurance

Protect your loved ones and gain peace of mind. Our payment protection† ensures your financial obligations will be met if you experience disability, critical illness or job loss, or in the event of your death.

Creditor insurance is available for the following products in the event of death, disability, and critical illness:

Furthermore, creditor insurance is also available for the following products in the event of job loss:

How can we help?

†Payment Protection Legal Disclaimer:

Creditor’s group insurance coverage is optional and is underwritten by Co-operators Life Insurance Company. Supporting services, such as enrollment intake, medical underwriting and claims administration are provided by the employees of CUMIS Services Incorporated. Coverage is governed by the terms and conditions of the creditor’s group insurance policy issued to the creditor and is subject to terms, conditions, exclusions and eligibility requirements. See the Product Guide and Certificate of Insurance for full coverage details.

Your financial well-being comes first

Welcome to a better way to bank. Our knowledgeable team puts your financial well-being first with good, caring and transparent advice while offering all the products and services you need.